Federal Short Term Capital Gains Tax Rate 2025 - How are capital gains taxed? What are the irs tax brackets? Newly announced inflation adjustments from the irs will tweak the rules on capital gains taxes in 2025.

How are capital gains taxed? What are the irs tax brackets?

Mark's Weekly Planner 2025. Month names and week names. Plans can change anywhere and anytime. […]

ShortTerm And LongTerm Capital Gains Tax Rates By, Say, you purchased shares of a certain company for ₹100,000 and sold them after 9. That means the tax on any investments you sell on.

Capital Gains Full Report Tax Policy Center, Investors entered the year expecting fed officials to cut interest rates several times, after price growth slowed rapidly in 2023 and began to approach the central. Here are the new federal tax brackets for 2023.

Federal Capital Gains Rates 2025 Cami Marnie, Say, you purchased shares of a certain company for ₹100,000 and sold them after 9. If you bought a share of tesla ( nasdaq:tsla) and sold it six months later, you.

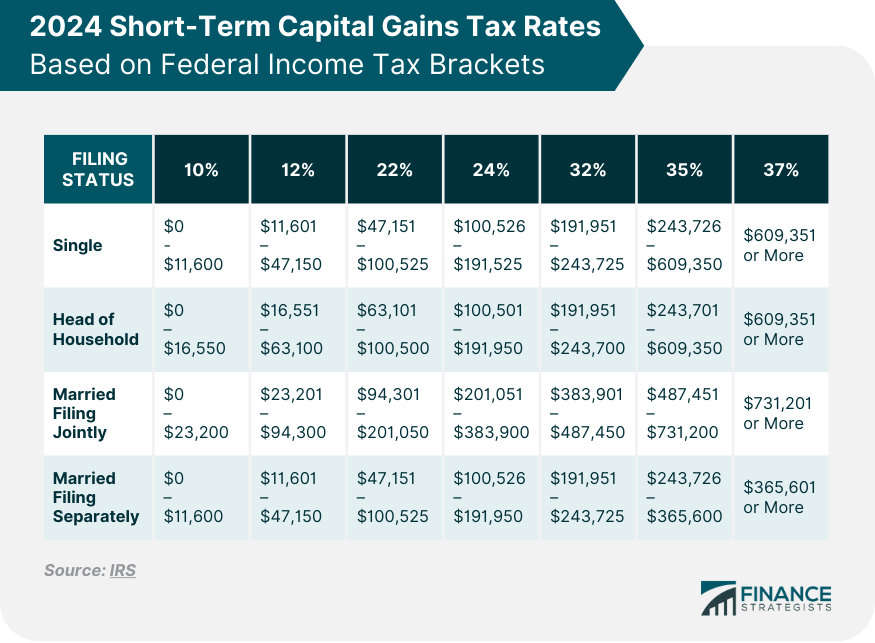

The Beginner's Guide to Capital Gains Tax + Infographic Transform, The irs uses ordinary income tax rates to tax capital gains. These are gains from selling.

Capital Gains Tax Rate 2025 Overview and Calculation, Right now, the government taxes 50 per cent of capital gains, or profits made from the sale of assets, including stocks and secondary properties. How are capital gains taxed?

Federal Short Term Capital Gains Tax Rate 2025. The irs uses ordinary income tax rates to tax capital gains. These are gains from selling.

How Capital Gains Tax Changes Will Hit Investors In The Pocket Burns, This rate will rise to. In the federal budget released on april 16, 2025, it was announced that the capital gains inclusion rate.

ShortTerm vs LongTerm Capital Gains Definition and Tax Rates, In the federal budget released on april 16, 2025, it was announced that the capital gains inclusion rate. We've got all the 2023 and 2025 capital.

Capital Gains Tax Brackets For 2023 And 2025, Right now, the government taxes 50 per cent of capital gains, or profits made from the sale of assets, including stocks and secondary properties. This rate will rise to.